|

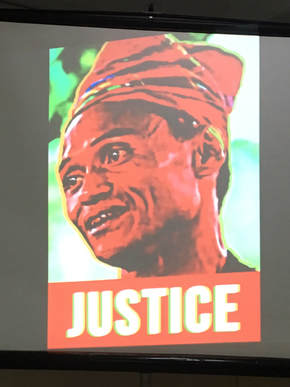

Bantay Kita strongly condemns the death of seven (7) members of the Indigenous Peoples T’boli-Munobo S’daf Claimant Organization (TAMASCO) during an anti-insurgency military operation in Barangay Ned, Lake Sebu, South Cotabato, Mindnanao, on December 3, 2017. TAMASCO tribal chieftain Datu Victor Danyan, his two sons Tantan, Jr. and Artemio, and son-in-law Dodoy were among the casualties.

Known to the National Commission for Indigenous Peoples, local government, and the Philippine Army as a staunch advocate the tribe’s land rights Datu Victor had been engaging in government processes and multi-stakeholder platforms since late 1990s. As TAMASCO chieftain, he had made known his tribe’s staunch opposition to the coffee plantation operated by Silvicultural Industries (SII), a subsidiary of David M Consunji, Inc. (DMCI). SII had been awarded Integrated Forest Management Agreement (IFMA) 22 which would have expired in December 2016. IFMA 22 covers about 11,000 hectares. TAMASCO’s ancestral domain encompasses land in South Cotabato and Sultan Kudarat, two provinces that share a political boarder. TAMASCO claims another agreement (IFMA 22-2007) which integrates and effectively extends IFMA 22, did not seek Free Prior and Informed Consent (FPIC) from the tribe. FPIC is a crucial step that allows the IPs to decide to allow or prevent the implementation of a project within their ancestral domain. Both IFMAs pertain to areas in Sultan Kudarat. IFMA 18-2007 was awarded to M&S Company, another DMCI subsidiary. It should be noted that of the approximately 29,000 hectares granted under IFMA in Sultan Kudarat, over 25,000 hectares has been conferred to DMCI subsidiaries. Through recent negotiations with government, TAMASCO alleges that it had been given the right to carve out 300 hectares of its ancestral domain from the prevailing IFMA. This had yet to be implemented. Meanwhile another DMCI subsidiary, DMC-Construction Equipment Resources Inc. (DMC-CERI) had been awarded a Coal Operating Contract (COC) in the area. To date, San Miguel Energy Corporation has a pending application that would also impact the TAMASCO ancestral domain. Through, multi-stakeholder engagements and available government platforms and processes, TAMASCO had openly opposed these projects in their desire to have control over their ancestral domain. Bantay Kita is deeply concerned that killings of advocates like Datu Victor Danyan are legitimized by military operations under the blanket of martial law prevailing in Mindanao. We demand for a fact-finding mission to uncover the truth and work towards ensuring that civic space is not threatened by such atrocities. Bantay Kita demands that the Government uphold the fundamental freedoms and provide safe spaces to express, organize and affiliate. *Update on the fact-finding mission

0 Comments

Bantay Kita commends the bicameral members for increasing the excise tax on mining companies from 2% to 4% in the Tax Reform Acceleration and Inclusion (TRAIN) Bill. But the coalition of natural resource governance advocates asserts, it is still not sufficient.

“This is a good start, but it is still low. In addition, we urge legislators to consider collecting royalties from all mining operations, not only those that operate within mineral reservation areas.” Bantay Kita National Coordinator Tina Pimentel expressed. Bantay Kita recommends imposing 5% mineral royalty payments for all mining operations based on market value of gross output. The current fiscal regime imposes 5% royalty payments only to mining operations situated in mineral reservations. To date, only four provinces have been declared by government as mineral reservations: (1) Zambales in Central Luzon, (2) Surigao del Norte, (3) Surigao del Sur, and (4) Dinagat Islands in the CARAGA Region. About 40% of large scale metallic mines operate within mineral reservations. Ms. Pimentel further asserts, “All mining operations in areas within the Philippine jurisdiction should be subject to royalty payments in order for the country to increase its benefits from resource extraction. Minerals are finite and once extracted, we only have one opportunity to benefit from it. Based on the 2016 PH-EITI Report, Php 2 billion was collected from large scale metallic mines as royalty from mineral reservation areas. Had all mining companies been levied this tax, we would have collected an estimated P4.5Billion from large scale metallic mining operations.” Bantay Kita is also advocating for the imposition of windfall gains tax and scraping of all unnecessary incentives accorded to mining companies. Windfall gains tax gives the government an opportunity to earn more when mineral prices are on the rise. Fiscal incentives are considered forgone government revenues. Bantay Kita estimates that from income tax holidays accorded to large scale metallic mines alone, the government has lost an estimated Php 5 billion in revenues for 2014. Bantay Kita also urges the legislators to maintain the corporate income tax rate imposed on mining companies, given that their contribution to the country’s GDP remains insignificant. Bantay Kita is hopeful that other mining fiscal reforms be included in the next comprehensive tax reform package. The administration is designing a new comprehensive tax reform known as TRAIN or Tax Reform for Acceleration and Inclusion (SB 1592) which includes reforms in the mining fiscal regime. Mining has failed to contribute significantly to government revenues. Based on figures reflected in the 2016 Ph-EITI Report, large scale metallic mines have contributed 1.1% to GDP. It is timely that TRAIN includes reforms in the mining regime to increase government share from the extractive industry. TRAIN proposes increase in excise tax from 2 percent to 4 percent based on market value of gross output. While other revenue streams remain, royalty payments in mineral reservations at 5 percent, indigenous people’s royalty at 1 percent, and 30 percent of net taxable income as corporate tax. Bantay Kita recommends imposing 5 percent mineral royalty payments for all mining operations based on market value of gross output. The current fiscal regime imposes 5 percent royalty payments only to mining operations situated in mineral reservations. To date, only four provinces have been declared by government as mineral reservations: (1) Zambales in Central Luzon, (2) Surigao del Norte, (3) Surigao del Sur, and (4) Dinagat Islands in the CARAGA Region. The government should maximize its gains from mineral resources. Extracting minerals is a one-time opportunity to improve people’s lives.

The effective tax rate (ETR) is the percentage of government’s share from total profits before tax. While, the average tax capture (ATC) is percentage share of government payments in gross value. With TRAIN and imposing the 5 percent royalty to all mining companies gives an ETR for all commodities and sites and ATC, 46% and 19% respectively. Using actual figures from the 2016 PH-EITI Report, the increase in excise tax from 2 to 4 percent, and imposition of 5 percent royalty on all mining operations will provide the government additional Php 4.3 billion. Recommendations

|

Previous Posts

May 2024

Topics

All

|

What We Do |

Know More |

About Us |

Contact Us

[email protected] | +(63) 917 5105 879 1402 West Trade Building, West Avenue, Brgy. Phil-Am, Quezon City, Philippines |