Cordillera Administrative Region and Region II

Region III and V Region IVB Region VI, VII, and VIII Region IX, X, and XI Region XIII

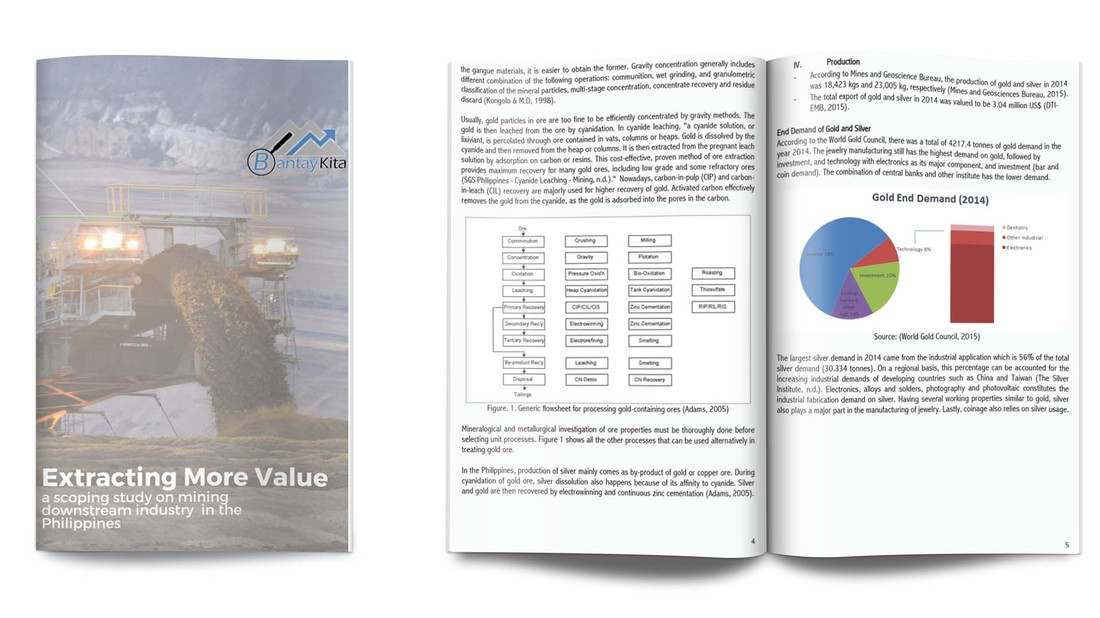

IntroductionPhilippines is endowed with huge metal reserves. Some areas in the country are already acquainted with mining and extraction of these metals and undeniably, we have local people who manufacture end products such as jewelries, steel products, etc.

Downstream industry in the country is already underway but it is losing pace because of several factors and challenges. Political support, fiscal policies, and effort to educate the public of its benefits on a national-level are needed to strengthen the weak link between the upstream and prevailing manufacturing industries. In this paper, downstream development strategies of other countries have been cited to serve as a basis in crafting and improving existing policies in the Philippines

IntroductionSeveral mining tax bills are filed in the 17th Philippines Congress. One of them is a bill Bantay Kita endorses.

In the Senate, three bills on mining tax reform are filed and two comprehensive mining policy bills with tax provisions. The Mining Industry Coordinating Council (MICC Bill) was filed by Senator Franklin Drilon under Senate Bill 225 and also by Senator Ralph Recto under Senate Bill 927. Senator Joel Villanueva, on the other hand, filed Senate Bill 1166 which Bantay Kita endorses. Senator Risa Hontiveros filed the Alternative Mineral Management Bill (AMMB) under Senate 1069 with several tax provisions. Similarly, Senate Grace Poe also filed the AMMB under Senate 1191. ExcerptThe collective idea to pursue multi-stakeholder initiatives to promote transparency in the mining industry of the province begun to take shape when the Compostela Valley Provincial Government in partnership with Bantay Kita, Paglilingkod Batas Pangkapatiran Foundation, Incorporated (PBPF) and the National Commission on Indigenous Peoples (NCIP) held a consultation among selected stakeholders discussing Extractive Industries Transparency Initiative (EITI) as a global undertaking promoting transparency.

Providing the context to the above-mentioned consultation are the various transparency issues confronting the indigenous peoples in the province. One glaring issue that gained the attention of stakeholders present, was the conflict arising among the leadership of the indigenous cultural communities already receiving royalty payments from operating mines. Another issue which was raised by the Provincial Local Government Unit (PLGU) was the lack of transparency and accountability in the sharing of National Wealth collected by the National Government from the mining operations. ExcerptIt is imperative to have a better understanding of how Mining Oversight Committees (MOCs) operate from a CSO perspective. By looking at the insights and actual experiences that CSO representatives in MMTs, MRFCs, and P/CMRBs in the province of Palawan, we can identify the strengths, benefits, and even the constraints or limitations of MOCs.

This study focused on documenting the actual experiences and insights of CSO representatives in the various Mining Oversight Committees (MOCs) to provide an indication on how MOCs operate from a CSO’s perspective. The respondents for this study were limited to six CSO representatives only. ExcerptBeneficial ownership disclosure is one key to guard against abuses and corruptions such as (i) dummy or subsidiary corporations violating the Philippines’ foreign ownership restrictions and (ii) politicians or government enterprises with obscured control or relationship over certain mining firms, unduly taking advantage of their position to enact biased policies or treat contracts unfairly. The same can help track individuals hiding illicit funds behind anonymous companies, and also help ensuring proper tax payments among firms. In 2014, The One Campaign[1] estimated that USD 1 trillion is lost annually from developing countries due to illegal cross-border transactions, which then partly arise from vagueness of company ownerships. [1] The Trillion Dollar Scandal Report (www.one.org) About the AuthorMadeleine Aloria is a researcher from Action for Economic Reforms, a nongovernmental organization conducting policy analysis and advocacy on key issues of economic reforms and access to information policies. She is a graduate of the University of the Philippines School of Economics.

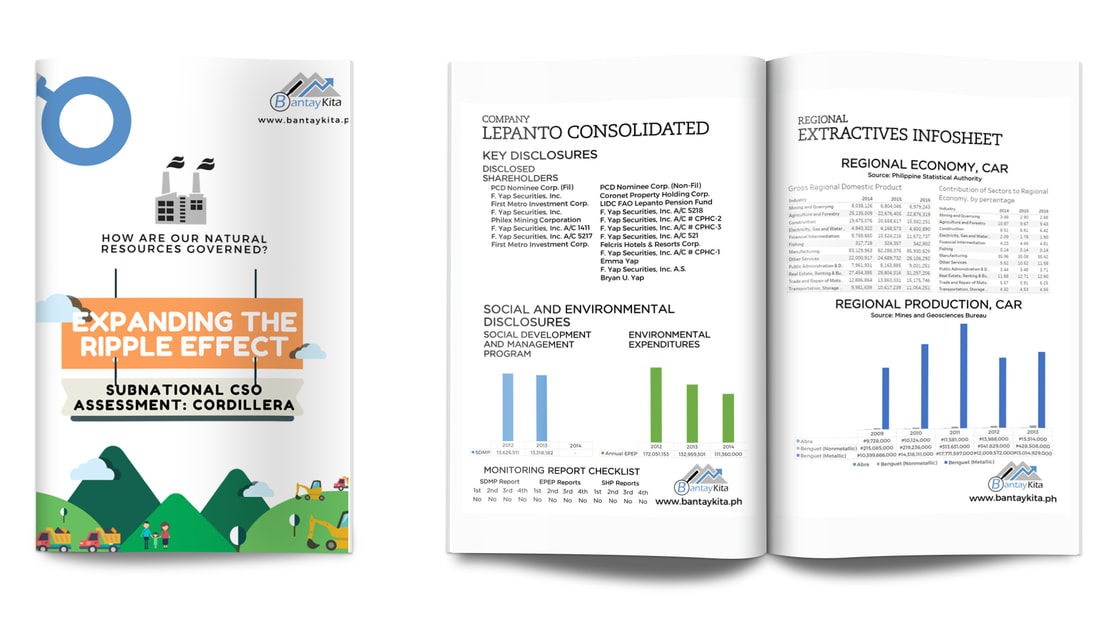

"Subnational CSO Assessment Primers" are prepared to provide contextualized materials for subnational stakeholders and assess project-level data and information. These primers may be downloaded by pdf format or may be browsed online in Bantay Kita's DATA Portal.

ExcerptThe combined market value of publicly listed companies in the extractiveindustry is estimated to be at P245 billion as of February 2016. Political

and financial influence of mining companies is undeniable. The extent of what we know about these companies is limited. Most disclosures of these companies are financial in nature. Most mining companies fail to disclose other documents and information mandated by Philippine law. The Mining Transparency Index (MTI) evaluates the extent of disclosure of the biggest large-scale metallic mining companies operating in the Philippines as well as that of concerned government agencies. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

What We Do |

Know More |

About Us |

Contact Us

[email protected] | +(63) 917 5105 879 1402 West Trade Building, West Avenue, Brgy. Phil-Am, Quezon City, Philippines |